Previously known as Entrepreneur’s Relief, Business Asset Disposal Relief (BADR) allows you to pay significantly less Capital Gains Tax when extracting profits from your company, so you can retain more of what you’ve built.

If you’re preparing to close a solvent limited company with retained profits over £25,000, a Members’ Voluntary Liquidation (MVL) enables you to treat those profits as capital—making them eligible for BADR and resulting in a far more tax-efficient exit.

But this advantage is changing very soon.

From April 2026, the effective tax rate on qualifying gains is set to increase from 14% to 18%, making the relief significantly less generous.

If your company is sitting on significant retained profits and is no longer needed, there’s a strong argument for closing it now while the current rules still allow you to extract value at the lowest possible rate.

What is Business Asset Disposal Relief?

Business Asset Disposal Relief is a tax relief set out in UK legislation, designed to reward business owners when they sell or close their company. It reduces the Capital Gains Tax (CGT) rate on qualifying gains from up to 20% down to just 14%.

It applies to individuals, not companies, and is typically used when:

- Selling a cash-rich business or shares in a trading company

- Closing a company that qualifies for an MVL

The lifetime limit for BADR is £1 million of qualifying gains. You can use the relief more than once, provided the total gains claimed stay within that cap.

Why use BADR instead of taking dividends?

The difference BADR makes can be substantial.

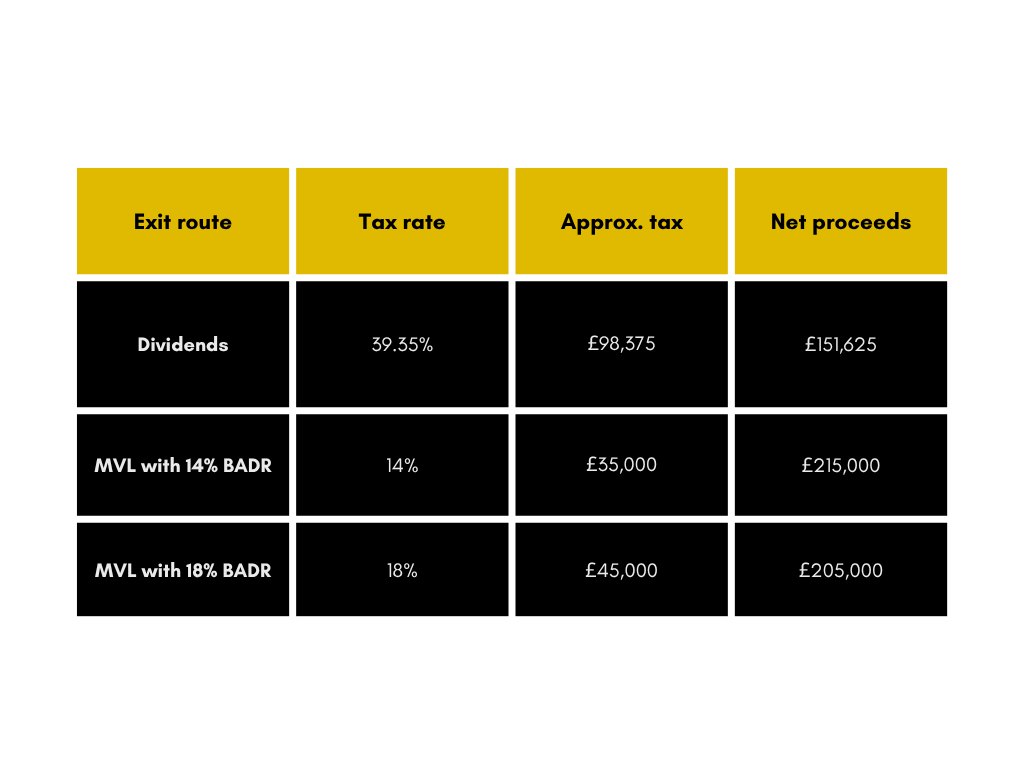

If you extract profits as dividends, the tax rate could be as high as 39.35%, depending on your overall income. But if your company is placed into MVL and those profits are treated as capital, BADR may apply, currently taxed at 14% and rising to 18% from April 2026.

For example, let’s say you’re closing your company with £250,000 in retained profits:

That’s a potential £63,375–£73,375 tax saving compared to dividends, depending on when you act. To get started, call us for a free, confidential MVL consultation.

What is a Members’ Voluntary Liquidation (MVL)?

An MVL is a formal process for winding up a solvent limited company. It allows you to:

- Distribute the company’s assets to shareholders

- Convert retained profits into capital for tax purposes

- Ensure a clean and compliant closure of the business

The process must be handled by a licensed insolvency practitioner (IP), who will manage all legal, tax and distribution requirements on your behalf.

When is an MVL an available option?

An MVL is ideal if:

- Your company has over £25,000 in retained profits

- You’ve settled all liabilities or can do so promptly

- You’re closing the business to retire, move into employment, or restructure

If retained profits are below £25,000, you can consider a Company Strike-Off. But above that threshold, the tax benefits of an MVL usually outweigh the costs.everything in order before the declaration is made.

Do you qualify for Business Asset Disposal Relief?

To access BADR, you’ll need to meet the following conditions for at least two years before the date of disposal (typically the date of final distribution in an MVL):

- You’re an officer or employee of the company

- You hold at least 5% of the ordinary share capital and voting rights

- The company is a trading company (not an investment company) or the holding company of a trading group

- The company hasn’t become inactive or investment-focused since trading ceased

In many cases, directors closing a business will qualify—but it’s important to double-check before proceeding.

Is BADR the same as Entrepreneur’s Relief?

IYes—Business Asset Disposal Relief (BADR) is effectively the same relief that was previously known as Entrepreneur’s Relief.

The name was changed in 2020, and at the same time, the lifetime limit was reduced from £10 million to £1 million. Despite this change in terminology and scope, the core purpose of the relief remains: to reduce Capital Gains Tax to 10% on qualifying business disposals.

If you’re familiar with Entrepreneur’s Relief, BADR is the current version of that same relief, still available under UK tax law.

What if you’ve used Entrepreneur’s Relief before?

If you’ve previously claimed Entrepreneur’s Relief, those gains count towards your £1 million lifetime BADR limit.

While the name has changed, the rules are broadly the same. Once you exceed the lifetime allowance, any additional gains will be taxed at the standard Capital Gains Tax rate—usually 20%.

Even with the reduced limit, extracting profits via an MVL and claiming BADR typically remains far more tax-efficient than taking the same value as dividends. in.

What’s the process for an MVL?

Here’s how a typical MVL unfolds:

- Pre-liquidation planning

Your accountant and IP prepare the company’s final accounts and ensure liabilities are settled. You may take any final salary or dividend at this stage. - Declaration of Solvency

The directors sign a statutory declaration confirming that all debts can be paid in full within 12 months. - Appointment of a liquidator

The insolvency practitioner is formally appointed and takes control of the process. - Distribution of funds

The company’s cash and assets are distributed to shareholders. These are treated as capital distributions, making them eligible for BADR. - Final tax clearance and strike-off

After receiving clearance from HMRC, the liquidator applies for the company to be struck off the register.

In straightforward cases, funds can be distributed within a few weeks. Final closure is typically completed within 6–12 months.

Common pitfalls to avoid

You may assume you qualify for BADR—but these common issues can catch directors out:

- Holding less than 5% of shares or voting rights

- Letting the company become an investment vehicle after trading stops

- No longer being listed as an employee or officer in the two years before liquidation

- Failing to plan ahead, especially around final transactions or timing

A brief conversation with your chosen insolvency practitioner can help you avoid these missteps and proceed with confidence.

How much does an MVL cost?

For a straightforward company with clean accounts and no complex assets, an MVL is often available for a fixed fee, typically between £1,000 and £3,000 + VAT.

This may sound like a cost—but in reality, it’s an investment. If using an MVL and claiming BADR saves you tens of thousands in tax, the return is clear. You should make sure you always work with a licensed insolvency practitioner who offers transparency on fees and process.

Can you do an MVL yourself?

No—UK law requires a licensed insolvency practitioner to carry out the MVL.

They’re legally responsible for ensuring the company’s debts are settled, documents are filed correctly, and distributions are made in line with insolvency law. Cutting corners isn’t an option here.

Working with a regulated professional also ensures the process is smooth, compliant and tax-efficient.

Want to claim maximum BADR? Act now

If you’ve built a successful company and you’re now looking to step away, it makes sense to do so on the most efficient terms possible.

Business Asset Disposal Relief is a generous relief that rewards you for your work—and using it through a well-managed MVL allows you to keep more of your hard-earned profits. With the right support, you’ll exit your company cleanly, legally and tax-efficiently.

We specialise in helping business owners like you exit smartly. Our team of licensed insolvency practitioners handles the MVL process from start to finish—so you can focus on what’s next.

Call for a free consultation today and see how much you could save.